New data reveals a stark divide between Fortune 100 mandates and the flexible firms driving employment growth.

Originally published on Allwork.space

The latest Flex Index data tells a story that should fundamentally reshape how workplace leaders think about their market. While headlines focus on high-profile return-to-office mandates, the real transformation is happening along company size lines. This has profound implications for anyone providing or managing office space.

Here’s the reality, based on our expanded study of over 9,000 U.S. companies: Two-thirds of organizations (66%) continue offering location flexibility, with only one-third (34%) requiring full-time office presence.

But dig deeper, and you’ll find we’re operating in a two-speed economy where size determines strategy — and growth is all on one side.

The Fortune 100 Tightens While Everyone Else Stays Flexible

29% of Fortune 100 firms now require employees to be in the office full time, but 45% now require either 4 or 5 days — meaning nearly half of Fortune 100 workers are in the office almost daily.

Compare that to the broader market: 67% of companies under 500 employees are Fully Flexible, meaning they can work remotely or, in many firms, in an office without a mandate.

Those smaller firms make up over half the U.S. workforce — and the only part that’s growing. For the first half of 2025, nearly all of the net change in employment in the U.S. came from firms with under 1,000 employees.

The companies demanding the most office time aren’t growing; the flexible ones are.

For CRE leaders, this creates a critical strategic question: Are you designing for the Fortune 100’s office-heavy approach, or for the flexible majority that’s actually driving job growth?

Flexible Plus Office Access: The New Standard

The most telling statistic from the Flex Index isn’t about remote versus in-office — it’s about hybrid maturation. 61% of firms have both flexible policies and provide access to office space. This “flexible with office access” model represents the stabilization of workplace strategy around a simple premise: give people choice while maintaining spaces for intentional gathering. It’s also a number that has not changed — at all — in the past year.

This shift demands a fundamental rethinking of office design and utilization metrics. As MillerKnoll’s Ryan Anderson puts it, we need to stop talking about “return to office” and start focusing on “reattaching to office.” The question isn’t whether people should come back — it’s whether we’re creating spaces that work for the needs of teams and individuals in 2025.

From Activity-Based to Relationship-Based Design

Anderson’s research on “relationship-based work” offers a framework for this transition. Instead of designing spaces around activities that can happen anywhere, successful offices are being redesigned to support interactions that can’t be as easily replicated digitally — strengthening “weak ties” while deepening team connections.

The evidence is compelling. Companies like Atlassian have transformed offices into highly modular environments where they’ve built adaptable spaces where virtually nothing is bolted down, allowing teams with low-cost paths to reconfigure as needs change.

Similarly, PagerDuty’s Toronto office redesign focused on creating environments that support different types of team interactions: “hackable” common areas, limited individual seating for quiet heads-down work, and an open common area.

The key insight: offices need to excel at what homes and digital tools can’t provide.

The Policy-Compliance Gap Persists

Mandated days are on the rise: the Q3 Flex Report found required office time climbed 12% since early 2024. But attendance increased only 1-3% through the end of Q2 (1% in Nick Bloom and team’s data, 3% for Placer.ai).

Policy shifts faster than behavior. This gap suggests that even in a softer job market, employees retain some leverage — particularly high-performing employees at companies that depend on talent retention — and at minimum managers won’t fire solid performers for showing up 2 or 3 days a week, but not 5.

Leaders creating anchor days helps people do what most already want: come in 2-3 days a week. But their workplaces also have to work for today’s needs.

The organizations seeing success aren’t just mandating presence, and they’re not just redesigning based on what executives say they want. According to Gensler’s Janet Pogue McLaurin, those that involve employees directly in the design process see far higher rates of success as well.

The Growth Advantage of Flexibility

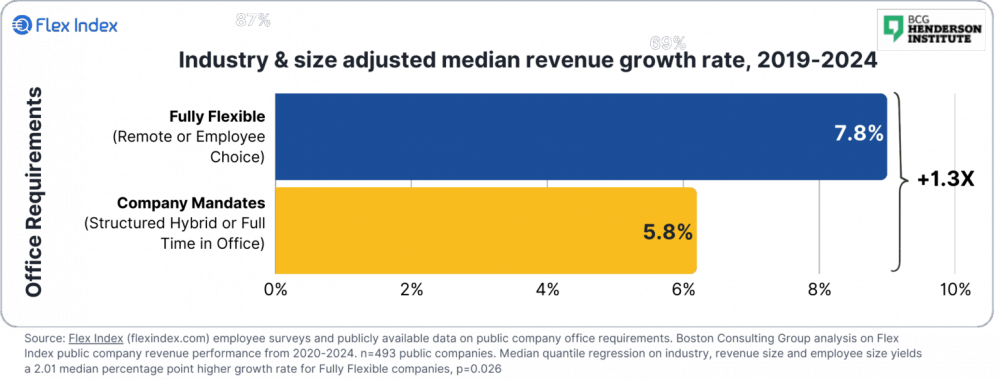

Perhaps most critically for business leaders, Flex Index partnered with BCG to look at the financial data of flexible firms versus those driving mandates. Fully Flexible firms, those without a mandate, grew revenues 1.7x faster than mandate-driven firms from 2019-2024. Even adjusting for industry and size, the growth advantage remains: growth rates 1.3X above peer companies.

This isn’t just about employee satisfaction — it’s about business performance. Flexible companies appear better positioned to access talent, adapt to change, and drive growth in an increasingly competitive market.

What This Means for Workplace Leaders

The data suggests three critical shifts for workplace strategy:

Size matters more than industry. Your approach should align with your company’s scale and growth trajectory, not just sector norms. Growing companies need the talent access that flexibility provides; established large firms may have different priorities.

Hybrid is the infrastructure play. The 61% of companies offering both flexibility and office access aren’t hedging their bets—they’re building for optionality. Offices become strategic tools for specific outcomes rather than universal requirements.

Design for attachment, not utilization. Success metrics need to evolve beyond badge swipes and booking rates. Spaces that create genuine connection and enable work that can’t happen elsewhere will outperform generic “collaboration zones” every time.

The two-speed economy is real, and it’s accelerating. Workplace leaders who recognize these dynamics — and design accordingly — will be positioned to support whichever speed their organization chooses to pursue.

The full Q3 Flex Index report is available for download at flexindex.com. For ongoing insights into workplace flexibility trends and research, subscribe to the free Flex Index newsletter.